Heavyweight corporate travel buyers are expecting to see domestic airlines dropping out of the market in South Africa, voicing concerns about high travel costs, government interference and airlines’ financial sustainability, a new University of Pretoria (UP) study shows.

The study, conducted by Professor Berendien Lubbe, was conducted among 33 corporations, more than half of which indicated a travel spend of more than R10 million per annum.

Responding to questions about the state of domestic air travel, 44% of respondents said they expected to see more domestic airlines withdrawing from the market over the next two years. Of the remaining respondents, 31% believe that airlines currently in operation will stabilise and survive in the medium to long-term; 28% say new scheduled airlines will enter the market; and 19% expect the market to grow quickly, with current airlines expanding their operations.

Respondents were also asked about their overall faith in the longevity of airlines currently operating in the domestic market, with FlySafair emerging as the airline in which the surveyed corporate travel buyers had the most faith.

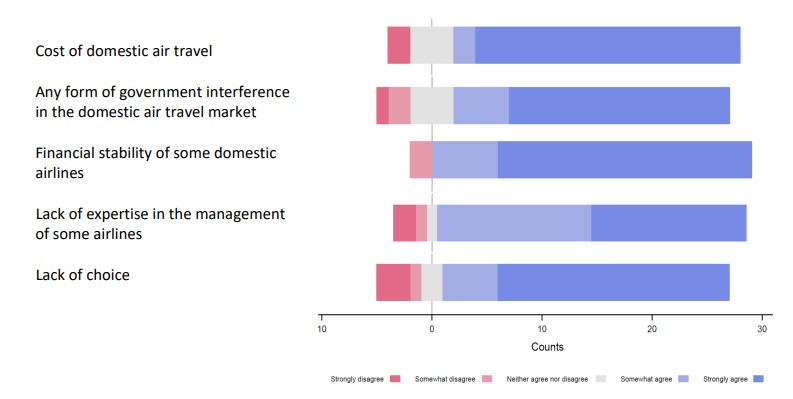

Lubbe found that the cost of air travel was a major concern for the companies surveyed.

“Business travel is highly lucrative for airlines, but with several international research studies suggesting that business travel will remain constrained due to tighter budgets and new ways of virtual working, airlines must review their service offerings in this market,” she said.

The financial instability of airlines, driven by the increased costs of doing business, was also identified as a top concern.

“By its very nature, the airline industry is structurally challenged due to high overhead and capital costs, which creates an uncertain environment for business travel. This is particularly true for managed corporate travel, which aims to maximise travel services to employees and minimise the cost,” Lubbe added.

Other concerns included government interference, lack of management expertise and a lack of choice of airlines.

Lubbe said the research had laid a foundation for a further study into the relationship between corporate travel buyers and regional and international airlines in South Africa, due to begin later this year.

‘Healthy equilibrium’

Kirby Gordon, Chief Marketing Officer at FlySafair, argued that the domestic aviation market was in a ‘pretty healthy equilibrium’, with capacity back at 75% to 80% of pre-COVID levels.

“That said, the ‘health’ of domestic aviation in South Africa is better measured by a view on balances than it is on overall size,” Gordon told Travel News, identifying several factors to evaluate, including connectivity between airports, supply and demand, competitive pricing and infrastructure and regulatory capacity.

“I’d give a big green tick for connectivity. SAA, Lift and FlySafair are doing a great job of putting ample capacity on the major routes, with the likes of Airlink and CemAir colouring in the rest of the gaps with connections to smaller airports,” Gordon pointed out.

Gordon stated his belief that there was currently enough competition in the market to sustain competitive pricing dynamics.

“Consider this. The US has 18 major carriers with 158 million employed citizens and 331,9 million people. We have a population of 60 million, of whom only 15,6 million are employed, and we have five airlines. So, in the US, you have 8,7 million employed people per carrier, and in SA you have 3,1 million employed people per carrier. We worry about competition, which we should, but there’s this flip side where you can have loads of airlines but not enough market to sustain each,” he said, adding that the five companies currently contesting the market was the same number as before COVID, considering that the now-defunct Mango and SA Express were both owned by SAA, and kulula.com and British Airways by Comair.

“Generally speaking, there is more than one carrier contesting any route that would be viable for more than one carrier to contest, and they’re all owned by different companies, so I would argue we’re actually really strong on that front,” said Gordon.

“I’d say we’re in a good space: both sustainable for airlines to survive, and highly competitive so that consumers see value without abuse.”