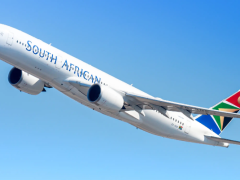

While the global aviation picture is one of strengthened profitability, the picture in Africa reflects the current environment of sustained demand against high operational costs, including many statutory taxes and charges on air transport, relatively weak economies and low foreign exchange reserves.

International airlines

According to IATA’s financial outlook for the global airline industry in 2025, international nett profits are expected to be US$36,6 billion (R647,8 billion) in 2025 for a 3,6% nett profit margin. This is a slight improvement from the expected $31,5 billion (R562,2 billion) nett profit in 2024, and the 3,3% nett profit margin.

Global airlines’ average nett profit per passenger is expected to be $7,0 (R125), below the $7,9 (R140) high in 2023 but an improvement on $6,4 (R114) in 2024.

Passenger demand (RPKs) is expected to grow by 8,0% in 2025, which is ahead of a 7,1% expected expansion of capacity (ATK).

African airlines

IATA expects that African carriers will achieve a $200 million (R3,6 billion) nett profit in 2025, for a 0,9% nett profit margin. Although the collective nett profit margin of African airlines is expected to be the weakest internationally, this represents a slight improvement on the $100 million (R1,8 billion) nett profit and 0,8% nett profit margin in 2024.

Additionally, predictions for 2025 profit per passenger exceed 2024’s prediction by $0,1 (R1,8), reaching a nett $1,0 (R18) profit per passenger.

Africa’s passenger demand meets international trends as it is expected to grow by 8%, while capacity is predicted to exceed international expectations and grow by 7,7%.

African carriers face unique issues, including a shortage of US dollars in some economies, which, along with infrastructure and connectivity challenges, hinder the airline industry’s expansion and performance. Despite these obstacles, the sustained demand for air travel is expected to improve the region’s profitability marginally in 2025, says the report.

The turbulent skies ahead

The report found that amid the strengthening of profitability, airlines were facing rising costs, a challenging environment and supply-chain challenges.

The main cost factors include salary pressure and once-off expenses due to employee strikes and maintenance costs for an ageing global fleet.

Factors that may impact the aviation sector include the spread of global conflict in the Middle East and Eastern Europe, the Trump Administration’s potential tariffs and trade wars, and the mercurial state of oil and fuel prices.

IATA reports that severe supply-chain issues will continue into 2025, hiking costs and hindering growth. The average age of the global fleet has risen to a record 14,8 years. While 2025’s aircraft delivery forecast is expected to exceed 2024 levels, it still falls short of 2018 levels.

“Supply chain issues are frustrating every airline with a triple whammy on revenues, costs, and environmental performance. Load factors are at record highs and there is no doubt that if we had more aircraft they could be profitably deployed, so our revenues are being compromised. Meanwhile, the ageing fleet that airlines are using has higher maintenance costs, burns more fuel, and takes more capital to keep it flying,” says Willie Walsh, IATA Director General.

“And, on top of this, leasing rates have risen more than interest rates as competition among airlines intensified the scramble to find every way possible to expand capacity. This is a time when airlines need to be fixing their battered post-pandemic balance sheets, but progress is effectively capped by supply-chain issues that manufacturers need to resolve.”