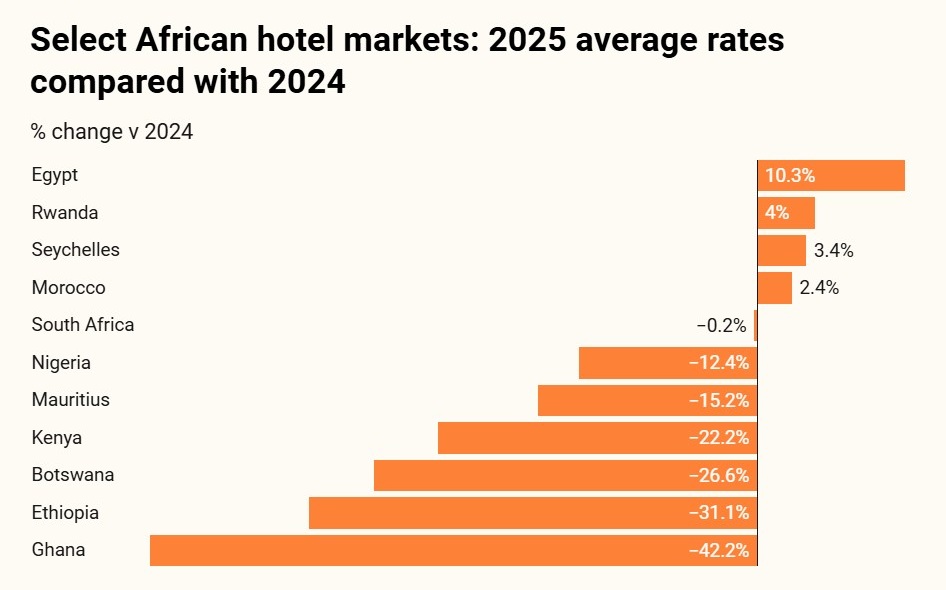

Hotel revenue management company Lighthouse has found that average hotel rates across Africa have fallen by nearly 20% year-on-year, driven by contractions within the three- and four-star markets and particularly sharp decreases for Ethiopia, Kenya, Botswana and Mauritius.

Lighthouse’s Global Hotel Rates: Q4 2025 Market Outlook analysed data gathered from almost 70 000 hotels in 185 countries.

The rolling 12-month average rate across African hotels dropped from US$201.19 (R3 250) in August 2024 to US$161.28 (R2 766) by August 2025. Ethiopia witnessed the sharpest drop among Southern and East African nations at 31.1%, followed by Kenya at 26.6%, Botswana at 22.2% and Mauritius at 15.2%. Rates in South Africa contracted by a marginal 0.2%.

The contractions were mainly felt in the three- and four-star segments, which recorded drops of 23% and 15% respectively. Luxury five-star properties were more insulated with rates broadly stable in the mid-US$350s (R6 000).

“What we see is a clear two-speed market where luxury hotels are generally protecting their rates while the mid-range is collapsing,” said Lighthouse Director of Hospitality Research Blake Reiter.

He said the divergence reflects the resilience of high-net-worth individuals on the one hand and the difficulties of intra-African travel on the other.

“The African middle class, which fuels a significant proportion of the middle-tier hotel segment, is under severe pressure from high inflation and currency volatility. Moreover, we are seeing visa restrictions that remain notoriously difficult for African travellers, severely constraining crucial intracontinental business and regional leisure travel.”

Some budget-conscious international travellers were also opting for cheaper, value-driven alternatives such as short-term rentals, putting more downward pressure on middle-tier hotel stock, Reiter added.

Forward-looking data for the region is more positive: Lighthouse pointed out that, in South Africa, for example, Q4 advertised rates in Cape Town are pacing 26% ahead of 2024 and Johannesburg by 23.6%, supported by event-driven demand such as the G20 Summit.